TINA is not the last winner of American Idol but an acronym used by some to explain the market’s resilience in the face of often conflicting economic data. TINA means “There is no alternative”. Given the current interest rate environment, many investors are putting their money where their mouths are believing that common stocks are the only rational investment alternative these days.

Each of the big three U.S. equity indexes (Dow Jones Industrial Average, S&P 500 and Nasdaq Composite) hit record highs in the third quarter of 2016, but their year-to-date gains (all under 10%) were not as impressive when compared with prior years’ gains. However, consider the context of the environment in which those gains were achieved; an 18-month slowdown in earnings, real GDP (gross domestic product) growth under 1.5%, the UK Brexit vote, conflicting monetary policy statements by different FOMC (Federal Open Market Committee) members and an absolutely crazy presidential election campaign in which more people plan to vote against one candidate rather than for another.

Common Stocks

The biggest news in the stock market happened overseas as emerging markets (MSCI EM) beat all major sectors with gains of 9.03% for the quarter and an impressive 16.02% for the year’s first nine months. Countries such as Indonesia, The Philippines and India are experiencing a gentle recovery in their growth rates and are countering the slowdown in China. It was a different story for developed international markets (MSCI EAFE) which lagged woefully behind due to slow growth in Europe and Japan and the uncertainty surrounding Brexit, all of which tempered investor enthusiasm.

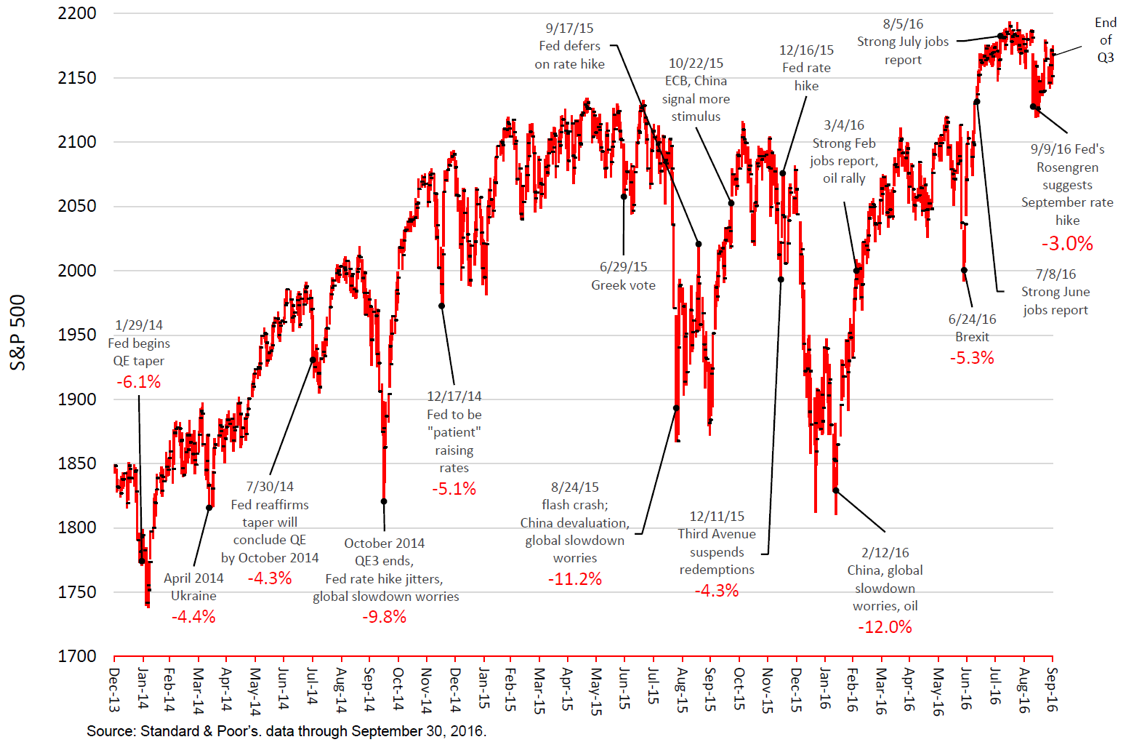

Back on this side of the pond, stocks finally broke through an 18-month trading range in early July following the release of a strong June jobs report. Companies then held onto their gains to finish the quarter in positive territory, albeit with many volatile back and forth sessions as investors reacted to the latest economic and political news. Markets don’t like uncertainty, and the result is increased volatility. For the quarter, U.S. stocks posted solid gains, led by small companies (S&P 600), up 7.20%. Year-to-date, U.S. small and mid-sized companies (S&P 400) joined emerging markets with double-digit gains.

Bonds

Bond yields are now at all-time lows, thus the TINA argument. Interest rates are normally a function of inflation expectations and the supply of and demand for credit. With inflation running around 1%, investors don’t currently require a significant inflation premium. Additionally, the federal budget deficit has improved from about 10% of GDP during the great recession to a more normal range of about 2.5% of GDP, reducing the government’s borrowing needs. On top of that, the ECB (European Central Bank) has implemented their own version of QE (quantitative easing) which is pushing global rates down further, even if artificially. Who in their right mind would buy long-term bonds in this environment? Maybe someone, but not us. Wealthview is keeping our bond maturities short and focusing on capital preservation with our “safe assets” so that if and when rates ever do rise we will be in a position to take advantage of it. Our bond benchmark (Barclays Capital 1-5 Year Government/Credit) posted gains of 0.04% and 2.64% during the 3rd quarter and first nine months, respectively.

What’s Next?

Earnings, elections, and interest rates would be the market’s three biggest concerns. Current projections are for another decline in 3rd quarter earnings for the S&P 500 companies which would mark the sixth straight consecutive earnings drop. However, as earnings decline, it becomes increasingly easier to post an eventual gain because the denominator is falling.

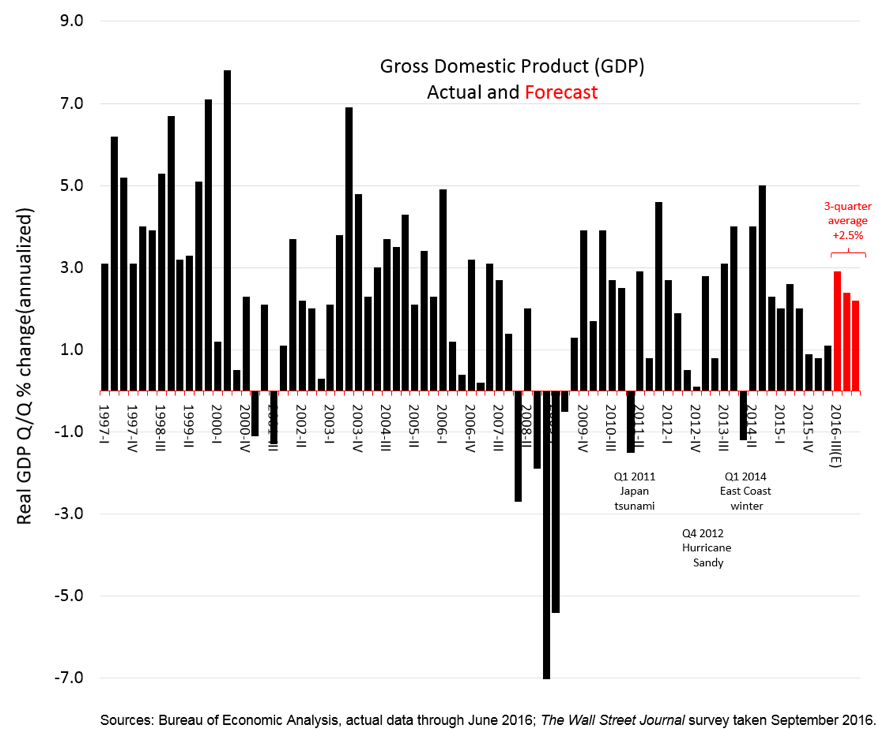

Additionally, a big part of the recent slowdown in GDP has been due to reduced capital spending (CAPX) by companies, and in particular, reduced inventories. Inventories cannot grow slower than sales forever, so at some point, we should see a nice rebound in CAPX and GDP could be in for a shock on the upside. Current forecasts predict growth of around 2.5% for the next few quarters compared to an average of 1.1% during 2016’s first half.

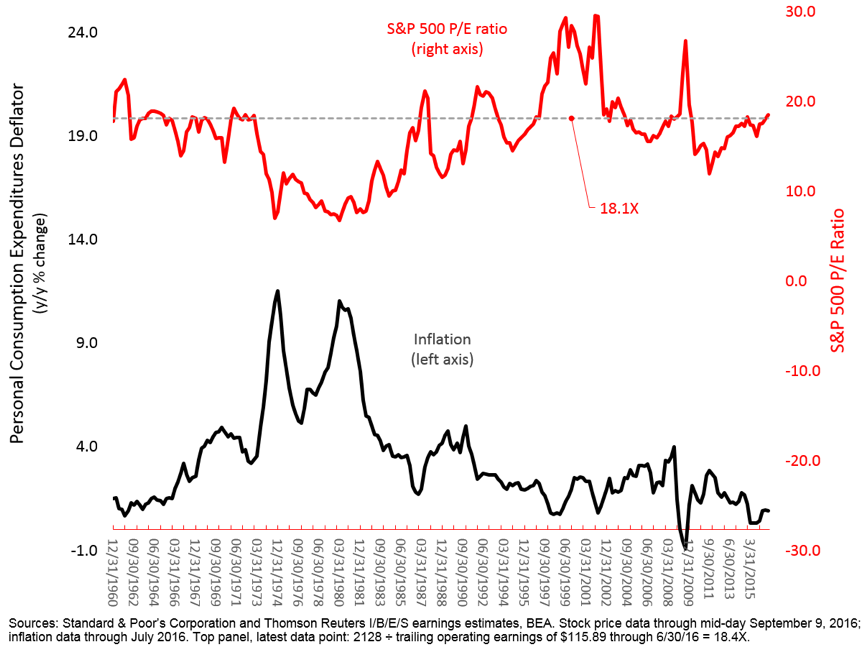

The uncertainty over next month’s elections is still overhanging the market. Each camp has opposite visions for the role of government and the tax policies to fund the government. With the S&P 500 trading at around 18 times trailing 12-months’ operating earnings and about 16 times forward earnings estimates, some are wondering if the market is overvalued. While no bargain, when put in the context of inflation (below) and interest rates, it is in-line with historical valuations. Short-term, what investors will demand as a return on their risk capital is a function of inflation and bond yields. The longer both stay low, the greater the chance investors will even raise the value they place on stocks. Over the long-term, earnings drive stock valuations pure and simple.

Plan, Execute, Monitor, and Move On

Plan, Execute, Monitor, and Move On

If there is one thing I know with certainty, it is the value of proper planning, prudent diversification, and periodic rebalancing.

Buying anything, especially stocks, because you believe there is no reasonable alternative (TINA) is a dangerous practice that can lead one to assume more risk than they may be able to tolerate. Of course, you won’t know that you have too much risk until you are in the middle of a market downturn and that is a bad time to find out. Investing in and of itself is not a goal, but a means to an end. It is the effective execution of a well-designed financial plan that lays out your goals and objectives and resources available to fund those goals; a plan that identifies the optimal asset allocation that offers you a reasonable probability of success but without unnecessary risk. The professionals at Wealthview Capital understand and embrace these truths and are honored to partner with our clients in the effective stewardship of their assets.

Best wishes for a pleasant fall,

Sam Taylor