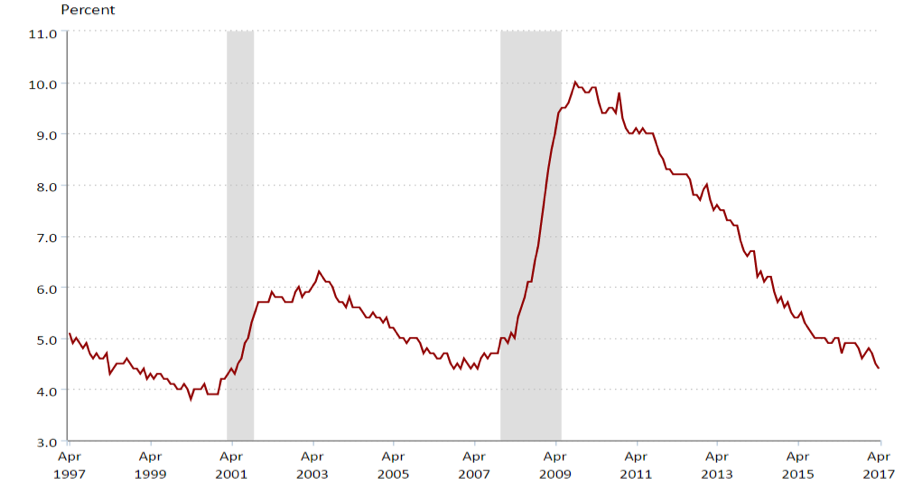

Contrary to the claims of the perpetual naysayers the state of the U.S. economy is very healthy. One evidence of this strength is our employment situation. From the depths of the great recession when the unemployment rate hit 10% we are now back to what many economists consider full employment.

Even though this economic cycle’s recovery (as measured by the growth rate in our gross domestic product) has been below average, net jobs formation has been longer and stronger than prior recessions (primarily due to the depth and severity of the jobs recession).

Civilian Unemployment Rate (Seasonally adjusted)

Ironically, our current unemployment rate of 4.3% (the lowest in 16 years) may hinder forward progress and it would not come as a surprise to see a period of little to no new jobs gains in upcoming months or quarters. Weekly claims for unemployment insurance are at all-time lows and the number of job openings is at an all-time high as companies are finding it more difficult to find qualified workers.

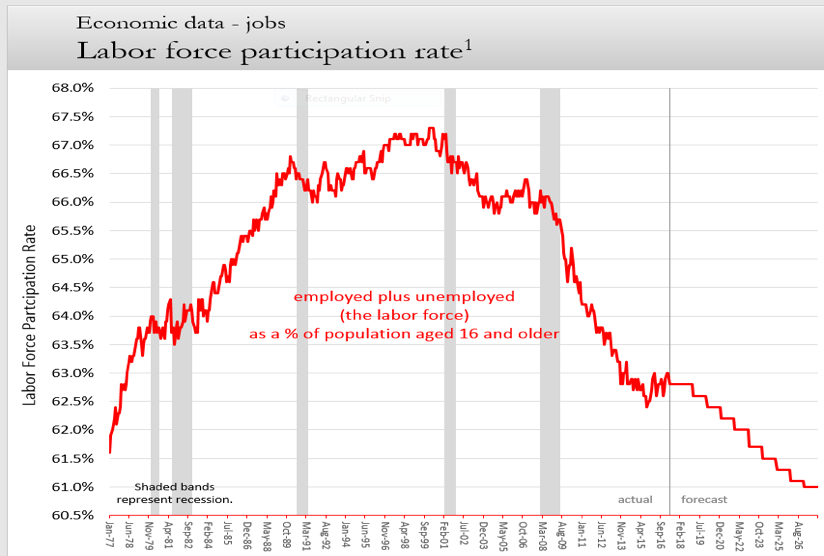

Yet, some people will point to the labor force participation rate as evidence the employment situation is not as robust as the unemployment rate suggests.

The participation rate measures the labor force (those working or actively seeking work) as a percentage of the civilian population age 16 and older. The disconnect here is that the participation rate has been in structural decline for years as the number of workers age 65 and older has been accounting for an increasing share of the total working age population due to the demographics of the Baby Boom generation.

The participation rate measures the labor force (those working or actively seeking work) as a percentage of the civilian population age 16 and older. The disconnect here is that the participation rate has been in structural decline for years as the number of workers age 65 and older has been accounting for an increasing share of the total working age population due to the demographics of the Baby Boom generation.

One impact of full employment is the likelihood of higher wage pressures as employers may need to pay more to attract and retain qualified workers. Wage-push inflation and full employment may give the Federal Reserve additional justification to continue raising interest rates. Higher rates would be welcome news to yield-starved, fixed-income investors but not so great for those looking to borrow.