“No one really knows how the game is played, the art of the trade, how the sausage gets made. We just assume that it happens.” - Hamilton an American Musical

It’s been said that if anyone ever watched sausage being made they would never eat it. The first quarter of 2017 went from being the Trump trade to sausage making as soon as the GOP rolled up its’ sleeves and got down to the actual process of attempting to enact the President’s first agenda item - repealing and replacing the ACA (Affordable Care Act), otherwise known as Obama Care. President Trump learned a valuable lesson in the art of dealing with Congress.

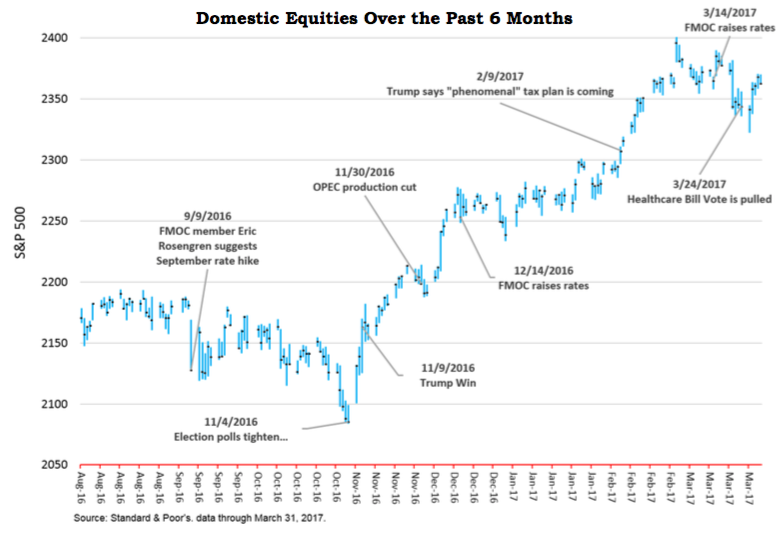

The stock market rally that began in the aftermath of the November elections continued into 2017 as investors believed a Republican coalition would reduce taxes and regulations while increasing spending, unleashing an economic juggernaut. Stocks posted substantial gains in January and February and then hit a brick wall in March once it became clear that repealing the ACA might not come to pass as quickly as promised. This “out-of-the-gate” policy failure led to concerns about other Trump agenda items being enacted, and the impact that might have on companies whose shares were being priced in anticipation of those policies. In our last commentary, we opined that the market’s recent gains could be premature if any headwinds materialized in the President’s efforts to enact his aggressive, pro-growth agenda. That is exactly what happened in the context of the ACA negotiations, but equities managed to hold on to most of their impressive gains from January and February and limped across the 1st quarter’s finish line producing one of the best quarters in recent years.

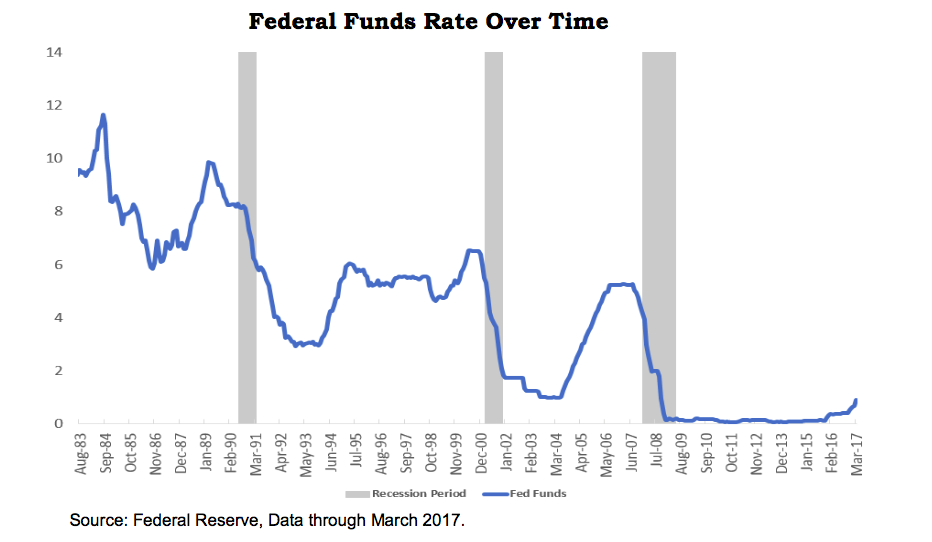

FOMC Raises Rates

The Federal Reserve’s Open Market Committee (FOMC) raised its benchmark interest rate on March 15th by 0.25% for the third time in this economic cycle and the second time in three months to a target range of 0.75% - 1.00%. Markets responded counter-intuitively as stock and bond prices rose and market-based interest rates fell in the wake of the Fed’s announcement. This is just another illustration why investors should not try to time the market, as you will likely wind up doing the exact opposite of what you should do.

The Fed is raising rates, in our opinion, not because the economy is over-heating, but to position itself to lower rates the next time the economy needs a boost. Our economy is currently healthy, which is allowing the Fed the flexibility to tighten credit without worrying about causing another recession. Additionally, the Fed is keeping a close eye on inflation and if it looks like things are over-heating, the FOMC may not have to raise rates as dramatically to cool things off. Large and frequent increases (or decreases) in the Federal Funds Rate can be disruptive to global markets and economies. A “steady-as-she-goes” approach is usually preferable.

Economy

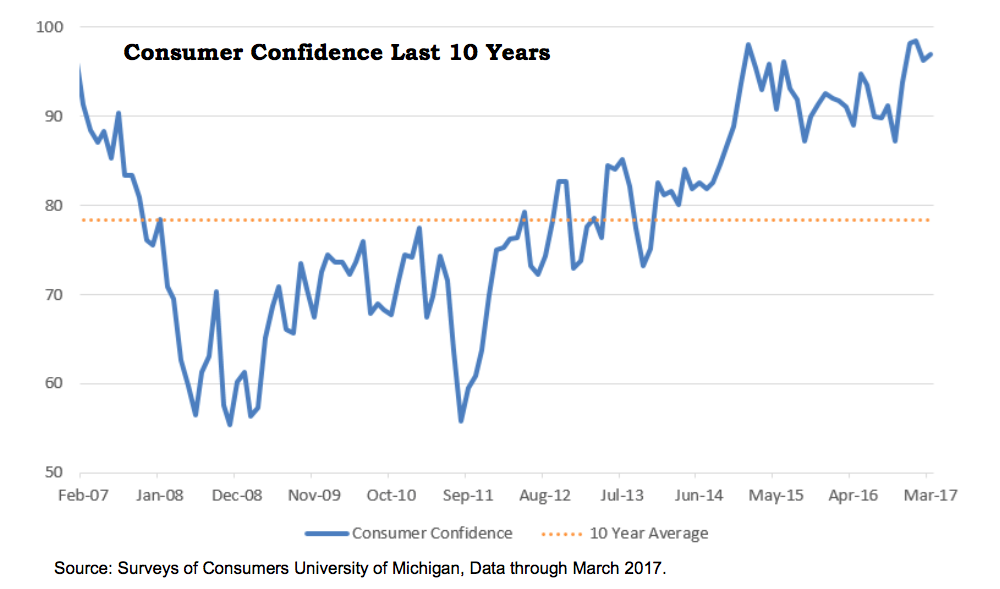

Consumer confidence is high and consumer income and spending remains healthy, which is important because the consumer makes up 2/3 of the economy. Although the U.S. economy continues to grow, its pace is less than impressive as re-affirmed by the latest reading on 4Q-16 GDP (Gross Domestic Product) which was revised upward from 1.9% to a 2.1% annual rate. The initial reading on first quarter, 2017 GDP won’t be released until April 28th and current forecasts are in the 1% (annualized) range. Compare those numbers to the 3-4% growth President Trump believes his policies will produce. He may be overly optimistic considering how difficult it is to get something done these days in Congress as evidenced by the ACA repeal debacle.

However, anything is possible, and reducing burdensome regulations can go a long way towards improving the economy. For example, a recent report by Rosen Consulting Group states that the feeble recovery is almost entirely due to a plunge in home ownership to more than 50-year lows which cost the economy 1.8% in growth last year, or about $300 billion. Even after an increase of 7.5 million new households over the past decade, there were nearly 1 million fewer homeowners in 2016 than in 2006. If regulations are rolled back to create a safe harbor for lenders it could be the key to bolstering home ownership and shifting the economy into a higher gear. According to Rosen, this could be done by simply changing regulations rather than through Congressional action.

Markets

The first quarter of 2017 proved to be a winner for equity investors, even after hitting the afore-mentioned brick wall in March when share prices fell. U.S. markets were led by large-cap companies (S&P 500) with gains of 6.07% but the real winner was international emerging markets (MSCI EEM) up 11.45% for Q1. Emerging markets companies’ out-performance has been attributed to attractive valuations (compared to more expensive U.S. companies), improving economies overseas and possibly a reversion to the mean since they had been lagging other markets for a long time.

The Trump trade’s waning enthusiasm gave way to increased investor feelings about the improving state of our overall economy and, especially, technology shares which led all sectors in Q1-16. The Trump trade’s favorite sectors, banks and infrastructure companies, lost ground during the quarter. Our bond benchmark (Bloomberg Barclays 1-5 Year Government/Credit Index) gained a modest 0.57% during the period as market rates did not move up concurrent with the Federal Funds Rate as previously mentioned. Rising yields causes bond prices to fall as they move inversely to one another.

What’s Next?

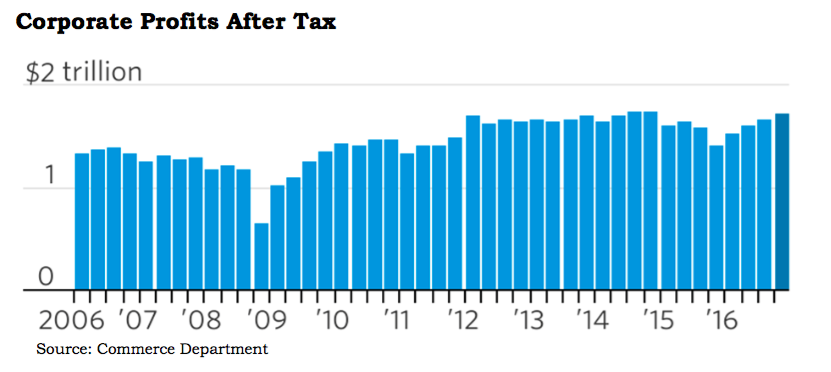

The stock market will continue to wax and wane as it always does in the short term, with its daily gyrations being a response to that day’s political and/or economic news. Longer-term, equity valuations will be a function of interest rates (bonds being the original alternative investment), inflation and earnings. The Federal Reserve’s monetary policy is data driven and if the data points to continued strength in our economy, you can expect the Fed to proceed with its gradual credit tightening. Inflation has inched up closer to the Fed’s 2% target range but is currently showing no signs of accelerating. For instance, wage gains are being offset by increased productivity. That leaves the third valuation leg - earnings.

Overall, 4Q-16 profits were up 3.7% (the fourth consecutive quarterly gain) and represented 9.2% of GDP compared to 7.8% of GDP in 4Q-15. For all of 2016 profits were up 4.3% versus a loss of 8.5% in 2015, a year characterized by lower commodity prices, a strong dollar and global economic weakness. At the end of the day, the single biggest determinant of a company’s valuation is its current and expected future earnings and by proxy, its dividends which it pays out to shareholders over time. It matters little whether technology companies like Apple Computer or infrastructure firms like Caterpillar are the best performers this quarter, or this year. What does matter is that you own both companies and sectors in an optimally constructed, broadly diversified portfolio that will participate in our global economies’ long-term growth.

Overall, 4Q-16 profits were up 3.7% (the fourth consecutive quarterly gain) and represented 9.2% of GDP compared to 7.8% of GDP in 4Q-15. For all of 2016 profits were up 4.3% versus a loss of 8.5% in 2015, a year characterized by lower commodity prices, a strong dollar and global economic weakness. At the end of the day, the single biggest determinant of a company’s valuation is its current and expected future earnings and by proxy, its dividends which it pays out to shareholders over time. It matters little whether technology companies like Apple Computer or infrastructure firms like Caterpillar are the best performers this quarter, or this year. What does matter is that you own both companies and sectors in an optimally constructed, broadly diversified portfolio that will participate in our global economies’ long-term growth.

Your specific allocation to equities (for growth), bonds (for income and stability) and cash (for liquidity) should be a function of your unique goals, objectives and risk tolerance. Wealthview Capital creates value by helping investors clearly define their goals and objectives and developing actionable plans to achieve those goals, yet without unnecessary risk. We then assume the responsibility for managing their requisite financial assets. And for our clients, that beats watching sausage being made any day of the week!