2023 proved to be as good a year for equities as 2022 was bad, even better. After last year’s rotten egg, this year’s gains were quite a pleasant surprise, especially given early-on negative consumer and investor sentiment, a banking crisis, two wars, falling earnings, and multi-decade high interest rates from the Federal Reserve’s aggressive credit tightening campaign. Following two years of up and down but mostly sideways action, equities bottomed in late October, then surged during November and December, with major indices near or surpassing all-time highs in response to cooling inflation, sustained economic growth and lastly, but most notably, a December pivot in monetary policy from the Federal Reserve. If 2023 taught us anything, it is how difficult it can be to predict the future.

In its December meeting, the Fed acknowledged that inflation was indeed well on the way to its 2% target and made an unexpected dovish policy announcement. FOMC (Federal Open Market Committee) members shifted their focus from the likelihood of another interest rate hike and higher-for-longer, to debating how soon and how often the Fed will begin lowering rates. The consensus opinion was for a continued pause followed by several cuts in 2024, with more to follow in 2025 and 2026, starting possibly as early as March. This was a remarkable about-face since Chairman Powell stated repeatedly that the Fed was still concerned about maintaining price stability and another rate hike was not yet off the table. The pivot was an early Christmas present for investors and proved to be the catalyst needed to propel equity prices upward.

In its December meeting, the Fed acknowledged that inflation was indeed well on the way to its 2% target and made an unexpected dovish policy announcement. FOMC (Federal Open Market Committee) members shifted their focus from the likelihood of another interest rate hike and higher-for-longer, to debating how soon and how often the Fed will begin lowering rates. The consensus opinion was for a continued pause followed by several cuts in 2024, with more to follow in 2025 and 2026, starting possibly as early as March. This was a remarkable about-face since Chairman Powell stated repeatedly that the Fed was still concerned about maintaining price stability and another rate hike was not yet off the table. The pivot was an early Christmas present for investors and proved to be the catalyst needed to propel equity prices upward.

If that wasn’t enough of an elixir, in late December the BEA (Bureau of Economic Analysis) released its November update of the Personal Consumption Expenditures (PCE) index, the Fed’s favorite inflation gauge. Through November inflation was up 2.6% year-over-year and prices dropped -0.1% month-over-month as compared to October with core PCE (excluding volatile food and energy) +0.1%. Over the past six months, core prices rose at an annual rate of only 1.9%. Another report like November’s could prompt the Fed to accelerate its monetary easing.

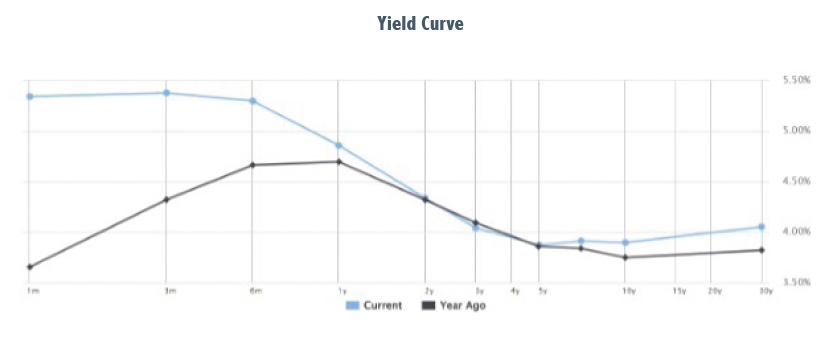

Bears, long expecting a recession and lower equity prices, were faked-out in 2023 by several indicators predicting a significant economic slowdown. The inverted yield curve, with short-term interest rates higher than long-term rates, while not a perfect predictor, typically precedes recessions. Housing starts and sales fell along with automobile sales, both sectors’ victims of higher borrowing costs and higher prices. Finally, the Conference Board’s LEI (Index of Leading Economic Indicators) remained negative in November for the 20th straight month, but the recession everyone saw coming never came. Yet, the Conference Board continues to forecast a short and shallow recession in the first half of 2024, pointing out that equity prices were the only positive contributor to the index during November.

Bears, long expecting a recession and lower equity prices, were faked-out in 2023 by several indicators predicting a significant economic slowdown. The inverted yield curve, with short-term interest rates higher than long-term rates, while not a perfect predictor, typically precedes recessions. Housing starts and sales fell along with automobile sales, both sectors’ victims of higher borrowing costs and higher prices. Finally, the Conference Board’s LEI (Index of Leading Economic Indicators) remained negative in November for the 20th straight month, but the recession everyone saw coming never came. Yet, the Conference Board continues to forecast a short and shallow recession in the first half of 2024, pointing out that equity prices were the only positive contributor to the index during November.

Bulls, on the other hand, took solace in numerous signals that pointed to a soft landing, such as a strong labor market that has not responded as many expected. The unemployment rate is 3.7% and the JOLTS report (Job Openings and Labor Turnover Survey) shows about 1.4 jobs available for every person looking for work. This is unusual because there are typically more people seeking employment than the number of jobs available. Net new job formation is cooling but at 199,000 in November, it is consistent with healthy economic growth. Also, the labor force participation rate has improved dramatically since the Covid shut down.

Real GDP (Gross Domestic Product), which measures the nation’s output of goods and services (after inflation), grew at an astonishing annualized rate of 4.9% in 3Q23 and current estimates for 4Q23 range from about 1% to 2.3%. Productivity gains, which help offset wage pressures for companies, were strong at 2.2% in 3Q23. Household net worth is above trend growth, feeding the wealth effect enabling consumers to continue spending which is borne out in strength in personal income and spending data. The M2 money supply (all cash on hand) is coming down but still above trend line, which along with the strong labor market, supports the case for a sustained economic expansion.

2023 was the year for large companies and technology as evidenced by the S&P 500 which gained 26%, including dividends. About two-thirds of the S&P 500’s gain was attributable to just a handful of companies, referred to as the Magnificent Seven, all but one of which is a technology company. If history is any indicator, those companies, currently trading at lofty valuations, should eventually give ground to other, less glamorous firms whose shares are more reasonably priced. Most broadly diversified equity benchmarks scored double-digit gains for the year, demonstrating the folly in trying to time the market. Investors who sat on the sidelines during 2023 paid a significant opportunity cost.

2023 was the year for large companies and technology as evidenced by the S&P 500 which gained 26%, including dividends. About two-thirds of the S&P 500’s gain was attributable to just a handful of companies, referred to as the Magnificent Seven, all but one of which is a technology company. If history is any indicator, those companies, currently trading at lofty valuations, should eventually give ground to other, less glamorous firms whose shares are more reasonably priced. Most broadly diversified equity benchmarks scored double-digit gains for the year, demonstrating the folly in trying to time the market. Investors who sat on the sidelines during 2023 paid a significant opportunity cost.

Bond investors also endured a roller coaster ride over the past two years. Beginning in early 2022 the Federal Reserve initiated a credit tightening campaign to combat the highest inflation in forty years by lifting interest rates at the fastest pace in forty years, taking yields from historical lows to the highest level in twenty-two years. This created unprecedented losses for bond holders, especially those with long-term maturities. Mortgage rates hit 8% and US Treasuries hit 5%. In March 2023 bond yields fell in the wake of the Silicon Valley Banking crisis from a flight to safety reaction before rising again as the Fed continued tightening credit.

Finally, in the 4th quarter of 2023, as inflation cooled and the Fed pivoted to its dovish posture, rates fell by over 100 basis points (a basis point is 1/100th of 1%). The 2-Year US Treasury dropped from a high of 5.22% in October to finish the year at 4.25%. The 10-Year US Treasury, which started the year at 3.88%, rose to 5.02%, then ended the year back at 3.88%. Our short-term bond benchmarks, the Bloomberg 1–5-Year Govt/Credit and the Bloomberg 1-5 Year Credit indices, finished the year with total returns of 4.89% and 5.94%, respectively.

As investors bask in the glow of their fattened portfolios, it is important to avoid chasing last year’s top performing companies and sectors or abandon long-term asset allocation policies. Some analysts believe the 4th quarter rally pulled forward returns from 2024 which could lead to lower-than-expected results in the new year. Since no one knows what any year will produce, it is usually best to stay committed to the investment strategy adopted within an intelligently crafted financial plan which is intended to increase the probability for investor success.

As investors bask in the glow of their fattened portfolios, it is important to avoid chasing last year’s top performing companies and sectors or abandon long-term asset allocation policies. Some analysts believe the 4th quarter rally pulled forward returns from 2024 which could lead to lower-than-expected results in the new year. Since no one knows what any year will produce, it is usually best to stay committed to the investment strategy adopted within an intelligently crafted financial plan which is intended to increase the probability for investor success.

Best wishes for a safe, healthy, and prosperous 2024.

Samuel J. Taylor, CIMA®, AIF®, CRPC®