An overriding focus for the past several months has been how soon, how often, and how much the Federal Reserve will cut interest rates after pausing its monetary tightening campaign. The Fed began aggressively raising the Fed Funds rate 11 times beginning in March 2022 from 0.00% - 0.25% to the current target range of 5.25%-5.50%, a 23-year high. To the surprise of few, the Federal Reserve’s Open Market Committee (FOMC) decided in its March meeting to wait yet again before cutting rates. The last increase in the Fed Funds rate was in July 2023, which means this rate pause was the fifth consecutive time the FOMC has voted to hold rates steady.

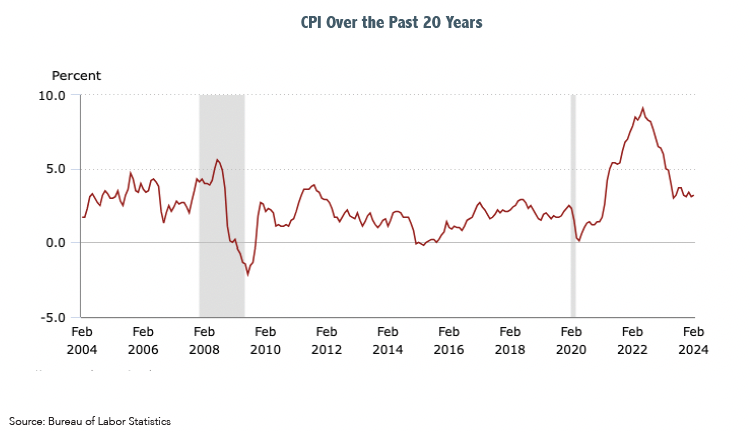

What is holding the Federal Reserve back from easing credit conditions? For starters inflation is stuck above the Fed’s 2% target rate. While it has cooled significantly from the highs reached during the peak of the COVID-induced economic dysfunctions, inflation has mostly trended sideways over the past few months. The CPI (Consumer Price Index) clocked in at 3.2% in February, compared to 3.1% in January. The Fed’s preferred inflation gauge, the PCE (Personal Consumption Expenditures Index) rose 2.5% in February, slightly above January’s 2.4% rate. After the March announcement, markets initially sold off when Fed Chair Powell said that the central bank has not won the battle against inflation, but then rallied to all-time highs when he said the Fed still expects three rate cuts before year-end.

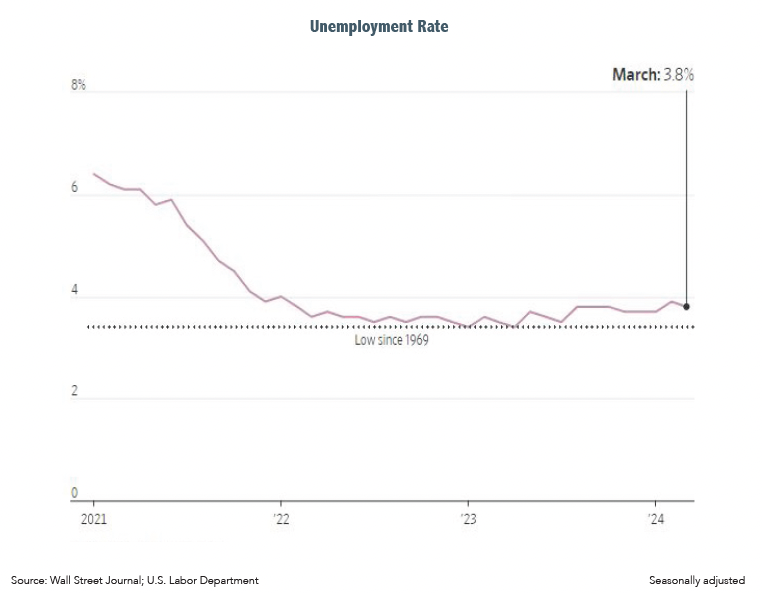

The Fed is also looking at a continued very strong labor market. In March the unemployment rate fell to 3.8%, the 27th consecutive month under 4% and non-farm payrolls rose by an unexpected 303,000 jobs. This is not the data the Fed wants to see to justify lowering interest rates. The JOLTS (Job Openings and Labor Turnover Survey) report shows over 1.3 jobs available for every person looking for work. While that ratio is falling, it still leaves plenty of room for wage pressures that can fuel inflation as companies could be forced to raise prices to offset increased labor costs absent a corresponding increase in productivity. Ideally, the Fed would like to see parity or slightly more workers seeking employment than jobs available.

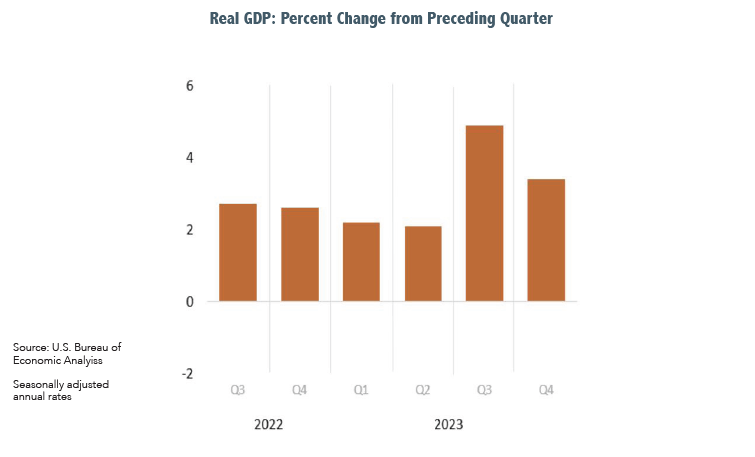

Finally, the U.S. economy is like the Energizer Bunny – it just keeps going and going and going. Growth as measured by real (after inflation) gross domestic product (GDP) increased at an annual rate of 3.4% in the fourth quarter of 2023, according to the ”third” and final estimate released by the Bureau of Economic Analysis. Current estimates are for real growth of about 2.5% in 1Q-24. Inflation-adjusted growth of 2.5% in a $28 trillion economy is a lot of growth. A large part of that growth is being driven by increased consumer and government spending along with increased productivity, up 3.2%, in which employees are producing more goods and services for every hour worked. Simply put, the Fed’s efforts to slow the economy are not producing the desired results.

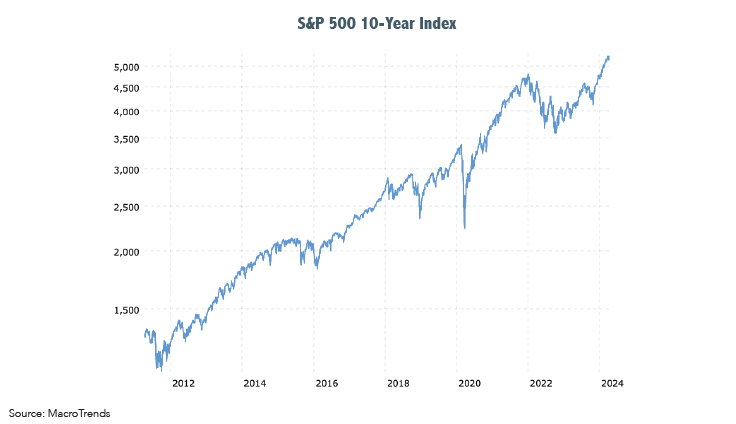

During this year’s first quarter, broad equity markets continued last year’s super-charged momentum, a reversal of the dismal returns experienced in 2022. Major equity indices hit new all-time highs during the period as investors rewarded increased earnings expectations backed by strong fundamentals. In 1Q-24, the market-cap weighted S&P 500 index rose 10.56%, and mid-cap stocks, (S&P 400 Index) rose +9.95%, indicating a broadening of the market’s breadth. To put a 3-month equity return of 10% in perspective, the long-term annualized return from common stocks is about 10%, so a pullback from here would not be unexpected.

At current levels, some investors may wonder if equities are overvalued. At 1Q-24’s end, large companies, as measured by the cap-weighted S&P 500 index, were trading at a forward PE ratio (price to earnings) of 21, which is a 17% premium to their 10-year average. However, much of that valuation is due to a handful of very large companies. Conversely, the equal-weight S&P 500 was trading at a PE of 17 times earnings, more in line with its 10-year average of 16.5X. Small and mid-cap companies are now trading below their long-term PE ratios and may offer more value. At current valuations, the leading companies must continue to meet or exceed consensus earnings expectations or potentially face a revaluation. For example, Tesla and Apple, two of the companies that had previously been driving much of the S&P 500’s returns, posted negative returns during the quarter after disappointing investors.

For fixed-income investors times are better than they’ve been in years. Interest rates had been close to rock bottom for much of the 15-year period that started with the 2007-2009 financial crisis. Then, as COVID-induced inflation proved to be non-transitory, we witnessed an unprecedented rise in both administered rates (Fed Funds, Bank Prime, Credit Cards, etc.) and market rates (bonds, notes, mortgage-backed securities, etc.). Investors holding long-term bonds learned a painful lesson in interest-rate risk. Now, rates are at levels not seen in years and the Fed is positioning to begin lowering them. However, last week’s hot jobs data will undoubtedly have the Fed re-thinking its credit-easing timing. Even if interest rates fall, most economists believe they will remain at elevated levels, allowing fixed-income investors to continue clipping coupons above inflation, producing real rates of return from investors’ “safe” assets.

For well over a year, numerous well-known market pundits have been forecasting economic doom and gloom from financial hurricanes, massive debt crises and catastrophic recessions. Yet, and despite much public sentiment to the contrary, the economy has continued to defy all nay sayers. For the rational, goals-based, planning investor, the probability of a recession should play no part in their investment strategy. That’s because their investment strategy is the result of an intelligent financial plan that already anticipates periodic recessions along with a myriad of other market-influencing factors that cannot be predicted. These investors know that and calmly go about their business allowing the panic-prone to respond impulsively to the latest Crisis du Jour.

Stay the course.

Samuel J. Taylor, CIMA®, AIF®, CRPC®

Wealthview Capital, LLC