Rising inflation has become a hot topic in 2021. Over the last year and a half, our world economy has experienced large shutdowns followed by trillions of dollars of stimulus. Now, as our economy fights to reopen, it is showing signs of not only having to battle COVID-19 but also higher prices. Inflation can make life difficult for both consumers and investors as its overall impacts can be unknown. However, one thing is for certain – excess inflation poses a real risk to our economy and everyday lives. To better understand inflation, it helps to pose key questions regarding it.

What exactly is inflation? Inflation is the general rise in prices for products and services over time. Said differently, it is the erosion of your purchasing power through time. One dollar a few decades ago could buy much more than one dollar today. For example, in 1970 one could buy a pound of bacon for $0.95 while today it costs close to $6.00. A dozen eggs in 1970 cost approximately $0.60, today $1.50. The purchasing power of your dollar has declined over time.

How is inflation measured? One popular measure of inflation is through changes in the Consumer Price Index (CPI), which is maintained by the Bureau of Labor Statistics (BLS) to track the prices of a weighted basket of commonly purchased goods and services such as energy, drugs, rent, education, food (like our bacon and eggs example), and more.

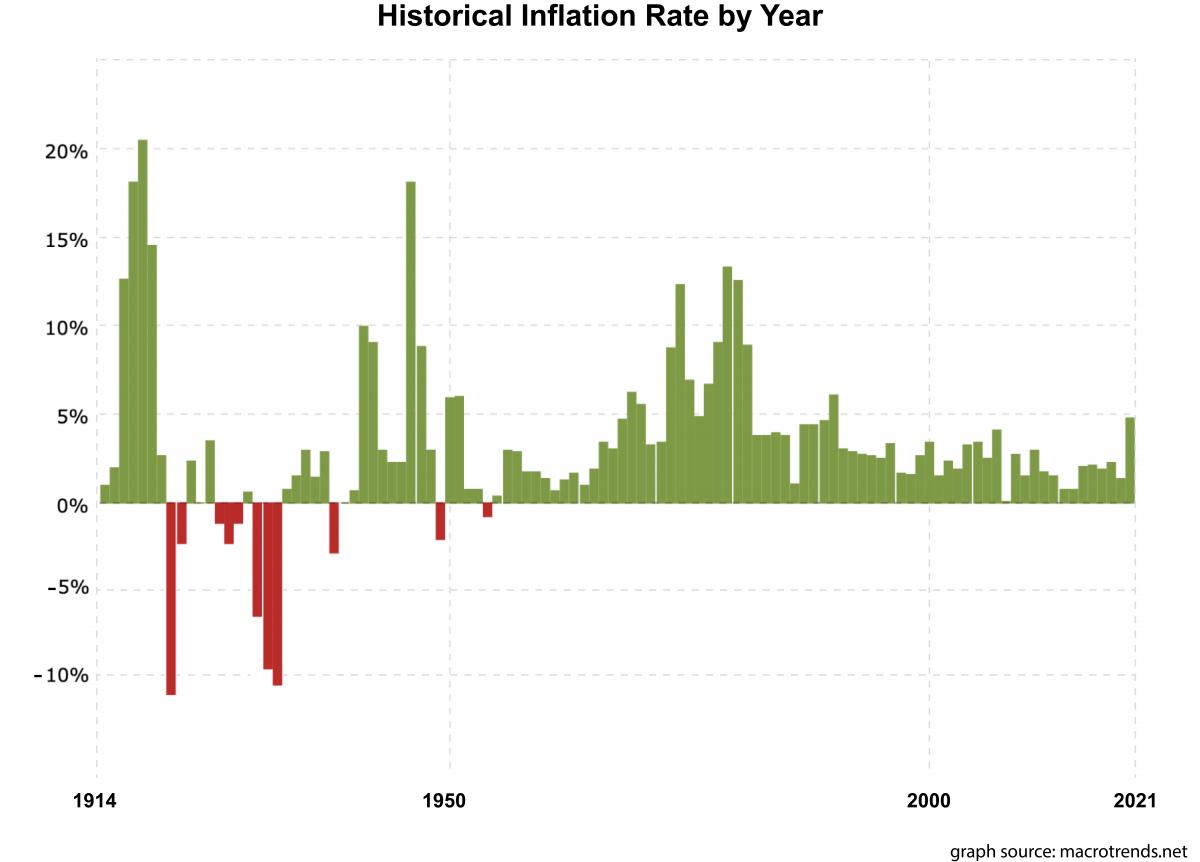

How has inflation changed? Over the past century inflation has varied greatly, including periods of hyper-inflation associated with World War I and World War II, and periods of deflation, most notably the early 1930s during the Great Depression. When many of our Baby Boomer clients were first purchasing homes in the late 70s and early 80s inflation hovered around 13%. However, in the wake of technological advancements and globalization, among other long-term trends, inflation has steadily declined and remained persistently low over the last few decades, averaging slightly more than 2% annually since 1990. For the most recent decade, 2010 through 2020, inflation averaged just 1.7%. If we look at the historical record, from 1926 to now – inflation averaged slightly less than 3% annually.

Why all the concern now after decades of low inflation? First, the most recent CPI readings showing a year-over-year 4.2% increase in April, a 5% increase in May, and a 5.4% increase in both June and July, not only exceed historical averages but represent increases not seen in several decades. Second, since April 2020, trillions of dollars have been, and are continuing to be, pumped into the U.S. economy to provide support after the COVID-19 shutdowns. These funds have come in many forms, such as bonds being purchased by the Federal Reserve, loans to businesses, checks sent to U.S. households, and support to local governments. Many believe this historically large injection of liquidity into a hot economy, combined with pent-up demand and rising production costs, has and will continue to lead to higher overall consumer and financial asset prices. Some level of inflation is healthy for a growing economy, but excessive inflation, or "runaway" inflation, is not.

The Federal Reserve, tasked with the responsibility of managing inflation, has been consistent in its belief and messaging that this recent spike in inflation will be short-term and insists it is due to supply-demand imbalances linked to economies emerging from COVID-19 lockdowns, all of which will be corrected in due time. For example, used car prices are up 45% over the past 12 months, most likely due to a shortage of new cars which is linked to a shortage of computer chips worldwide, all combined with an increased demand for cars. Once the chip supply catches up with demand, the market for prices should normalize, or at least that is what Economics 101 tells us.

But what if the rise in prices is here to stay, or becomes “sticky"? What if some markets normalize quickly and others do not? What does inflation mean for the markets? First and foremost, rising (above average) inflation does not mean an imminent market crash. There are many aspects to consider when thinking of inflation’s potential impact on the markets, such as company earnings, interest rates, wages, dividends, government policy, etc. Some factors may be positively or negatively impacted.

For example, if higher inflation persists, we should expect to see higher interest rates. Higher interest rates generally lead to negative effects on the economy and stocks in the short term due to multiple reasons such as:

- Increased borrowing costs for companies can lead to reduced profits. Market participants will lower their value of companies in response.

- Increased borrowing costs for consumers can lead to a slowdown in demand as monthly payments for homes, cars, etc. become more expensive.

- An increase in the discount rate used to value stocks can lower stock prices. Due to higher interest rates, market participants will raise their required returns needed to invest in stocks, leading to lower prices they are willing to pay for stocks (a re-pricing of financial assets).

- Higher yields can provide alternative investments to stocks. One may not like bonds at lower rates, but if yields rise may sell stocks to buy bonds.

Does this mean you should not be in stocks if you expect higher inflation? No, stocks remain one of the best investments against inflation over the long run. As costs increase, companies can raise their prices to maintain profits (or even increase profits) while either sustaining or increasing their cash flows. In the long run, it is cash flows, earnings, and execution that the market cares about. Increasing cash flow also allows companies to increase dividends, providing a higher income return to their shareholders. Not to mention, companies will continue to innovate, finding new ways to lower costs and prices.

As mentioned before, many experts believe the recent rise in inflation will be temporary. Once the economy fully reopens, supply should catch demand, and prices may return to previous levels. But what if it does not? What should you, the investor, do? The short answer is to be patient and stay committed to a diversified portfolio. There is no silver bullet against inflation as various asset classes have had differing successes over the years combating inflation. Further, moving money for a short period of time from one asset class to another requires making a market call. Not only would you need to be right about your inflation projection, but you would also need to be right about its impact on your current assets vs. the assets you replace them with. There is ample opportunity to make an incorrect call. As we have learned, markets rarely act as you think they should in the short term, just look at 2020.

It is impossible to know if today’s inflation will be transitory or more permanent. As always, with investing, it is prudent to stay committed to the long term and to a well designed financial plan – one that considers the impact of inflation over time while incorporating an appropriately diversified asset allocation designed to enable you to meet your goals, no matter the market environment.

Jonathan Waide, CFA®, CRPC®