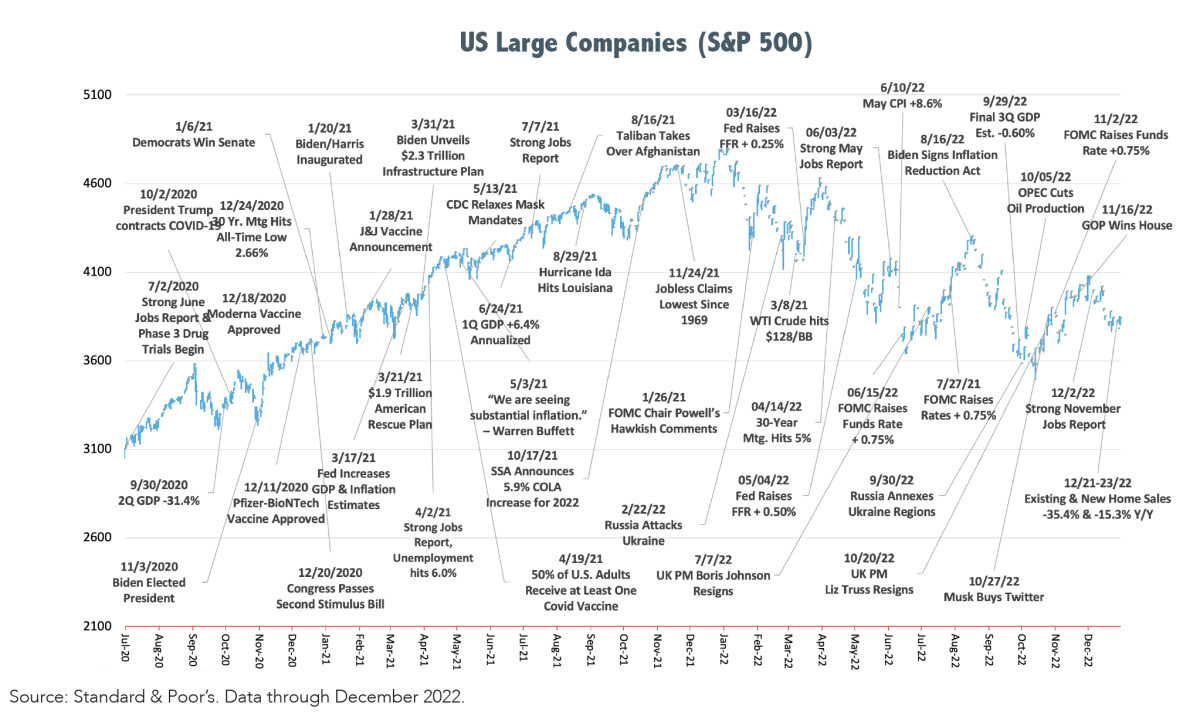

December closed the books on a disappointing year for investors. The continuing COVID-19 pandemic, 40-year-high inflation, supply shortages, rapidly rising interest rates, war in Ukraine, and a meltdown of cryptocurrencies took their toll across the board. Equities staged numerous short-lived rallies throughout the year on false hopes of peak inflation and a more accommodating monetary policy from the Federal Reserve. Each time those gains were clawed back as peak inflation remained a mirage. Then, after one more attempt in October and November, the year’s final quarter ended on a positive note. Bond prices fell consistently in 2022 as interest rates sky-rocketed and speculators in cryptocurrencies learned a painful lesson in what can happen when things don’t go as expected.

The market’s overriding concern currently is if the Fed will over-tighten and create a recession, leading to higher unemployment, reduced earnings, lower valuations, and to what Fed Chairman Jerome Powell alluded numerous times, a season of pain. Speculation that the Federal Reserve would halt its aggressive interest rate hikes that began in March was quieted by Chairman Powell after the December FOMC (Federal Open Market Committee) meeting, during which it raised the fed funds rate for the seventh time this cycle. Powell argued that the Fed needs to remain aggressive to bring inflation back down to it 2% target. He made it abundantly clear that once the fed funds terminal rate (now projected at 5.10%) is reached, the Fed intends to hold steady at that rate for an extended period to avoid mistakes made in the past by prematurely reducing rates. So, it looks like higher for longer and the question now becomes if a Fed-induced economic landing will be soft or hard.

The market’s overriding concern currently is if the Fed will over-tighten and create a recession, leading to higher unemployment, reduced earnings, lower valuations, and to what Fed Chairman Jerome Powell alluded numerous times, a season of pain. Speculation that the Federal Reserve would halt its aggressive interest rate hikes that began in March was quieted by Chairman Powell after the December FOMC (Federal Open Market Committee) meeting, during which it raised the fed funds rate for the seventh time this cycle. Powell argued that the Fed needs to remain aggressive to bring inflation back down to it 2% target. He made it abundantly clear that once the fed funds terminal rate (now projected at 5.10%) is reached, the Fed intends to hold steady at that rate for an extended period to avoid mistakes made in the past by prematurely reducing rates. So, it looks like higher for longer and the question now becomes if a Fed-induced economic landing will be soft or hard.

Broad equity markets delivered negative returns for the year with domestic large companies (S&P 500) falling -18.11% (including dividends) and the tech-heavy NASDAQ composite index incurring over-sized losses of -33.50%. Developed international markets (MSEAFE) fell -14.45% and international emerging markets fell -20.09% for the full year. The fourth quarter experienced see-saw action and finally bucked the year’s negative momentum as investors still believe we are getting ever closer to a more accommodative Federal Reserve. For the quarter, the best domestic returns came from mid-sized companies (S&P 400) +10.87% and internationally from developed markets (MSEAFE) which jumped +17.38%.

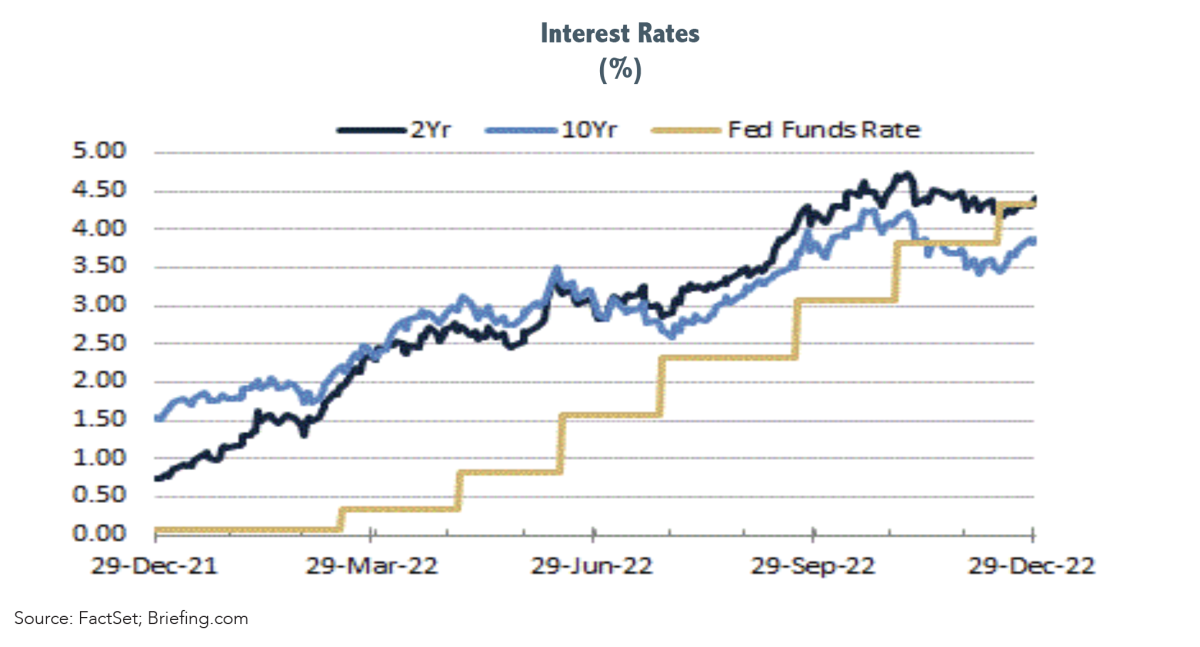

The bond market experienced possibly the worst year on record for fixed-income as interest rates went up a lot and fast in response to the Fed’s efforts to get inflation under control. Bond prices typically move in the opposite direction of interest rates, so when rates increase bond prices fall to adjust to market rates. To put things in perspective, at the beginning of the year the 10-Year Treasury Note was yielding 1.51% and finished the year at 3.88%. The 2-Year Treasury Note went from 0.72% to 4.24% during the same time-period. The fed funds rate was at a range of 0.00% - 0.25% on 12/29/21 and now sits at a range of 4.25% - 4.50%. As is evident, short-term rates increased more than long-term rates and are currently higher than long-term rates resulting in an inverted yield curve. Inverted yield curves often, but not always, precede a recession.

Most of the damage in the bond market came from longer-term and/or lower-quality bonds as investors paid dearly for seeking extra yields from those fixed-income sectors. Wealthview’s fixed-income strategy has been to focus on shorter-duration, higher-quality holdings which fell much less in value than longer-duration, lower-quality bonds. Shorter-duration, higher-quality bonds also fell much less than stocks and proved once again to be a prudent way to temper equities’ inherent volatility. Wealthview’s fixed-income benchmark, the Bloomberg 1-5/Yr. Gov/Credit index, fell -5.5% for 2022 and gained +1.2% for 4Q-22. While no one embraces reduced portfolio values, it is somewhat comforting to finally reinvest maturing bond proceeds and new cash into higher-yielding fixed-income securities.

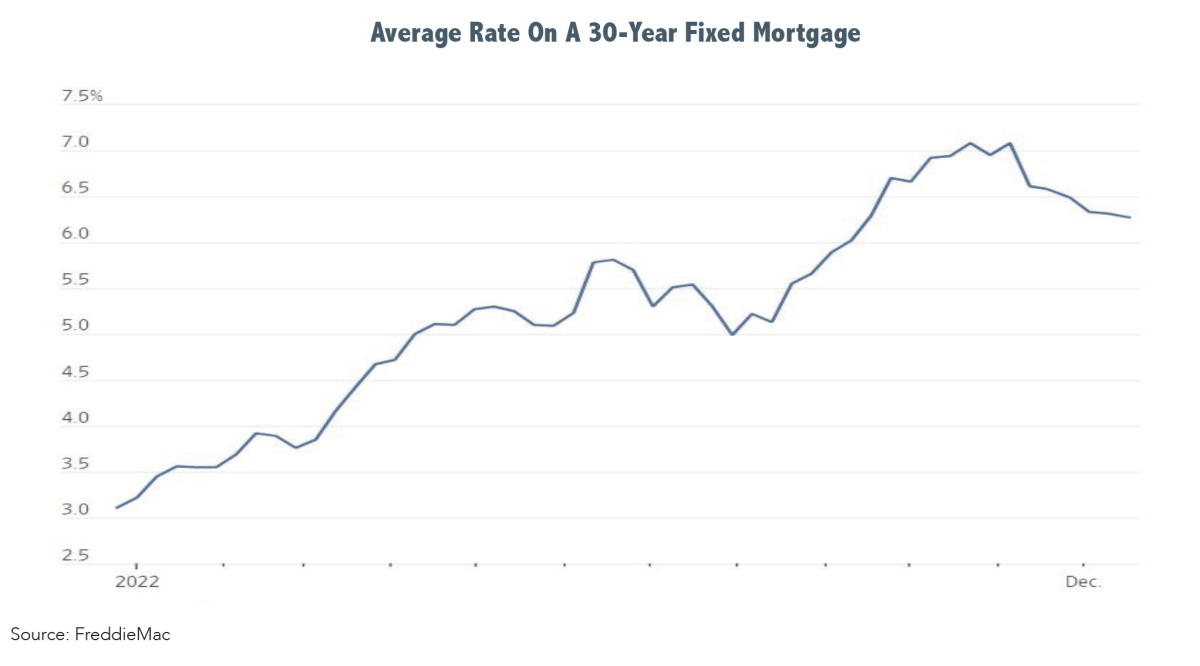

Many sectors of the economy are slowing as the effects of rising interest rates are working their way through the system. No sector has more influence on the overall economy than housing. Sales of existing homes dropped for a record tenth consecutive month in November and home prices followed suit as mortgage rates continue to pressure home buying demand. Housing has a broad economic ripple effect impacting building materials, appliances, furnishings, home goods, heavy equipment, labor, and more.

The latest Wall Street Journal’s Economic Forecasting Survey of 70 economists from academia, business and finance predicts the U.S. will enter a mild recession next year. They think real (inflation adjusted) GDP (Gross Domestic Product) will contract modestly in the first two quarters of 2023 before improving modestly in the second half of the year resulting in full-year GDP growth of just 0.44%. In its December meeting the Federal Reserve lowered its projection for 2023 real GDP growth to 0.5% from its September forecast of 1.2%. The IMF (International Monetary Fund) is forecasting global GDP growth to slow to 2.7% in 2023 down from 3.2% in 2022 and for global inflation to fall to 6.5% from 8.8%, still unacceptably high.

The latest Wall Street Journal’s Economic Forecasting Survey of 70 economists from academia, business and finance predicts the U.S. will enter a mild recession next year. They think real (inflation adjusted) GDP (Gross Domestic Product) will contract modestly in the first two quarters of 2023 before improving modestly in the second half of the year resulting in full-year GDP growth of just 0.44%. In its December meeting the Federal Reserve lowered its projection for 2023 real GDP growth to 0.5% from its September forecast of 1.2%. The IMF (International Monetary Fund) is forecasting global GDP growth to slow to 2.7% in 2023 down from 3.2% in 2022 and for global inflation to fall to 6.5% from 8.8%, still unacceptably high.

The Fed lost substantial credibility for sticking to its forecast that inflation pressures would prove to be transitory in the face of irrefutable evidence to the contrary. Once it became apparent that inflation was not transitory it waited too long to tighten credit. So, one of the biggest unknowns as we head into the new year is if the Fed will make another error and create a recession in its attempt to tame inflation, or if it can bring the economy in for a soft landing. A soft landing occurs when the Fed tightens monetary policy just enough to reduce inflation but without causing a recession. Should the Fed over-tighten and create a recession, as many now expect, will it be deep and long-lasting or brief and shallow?

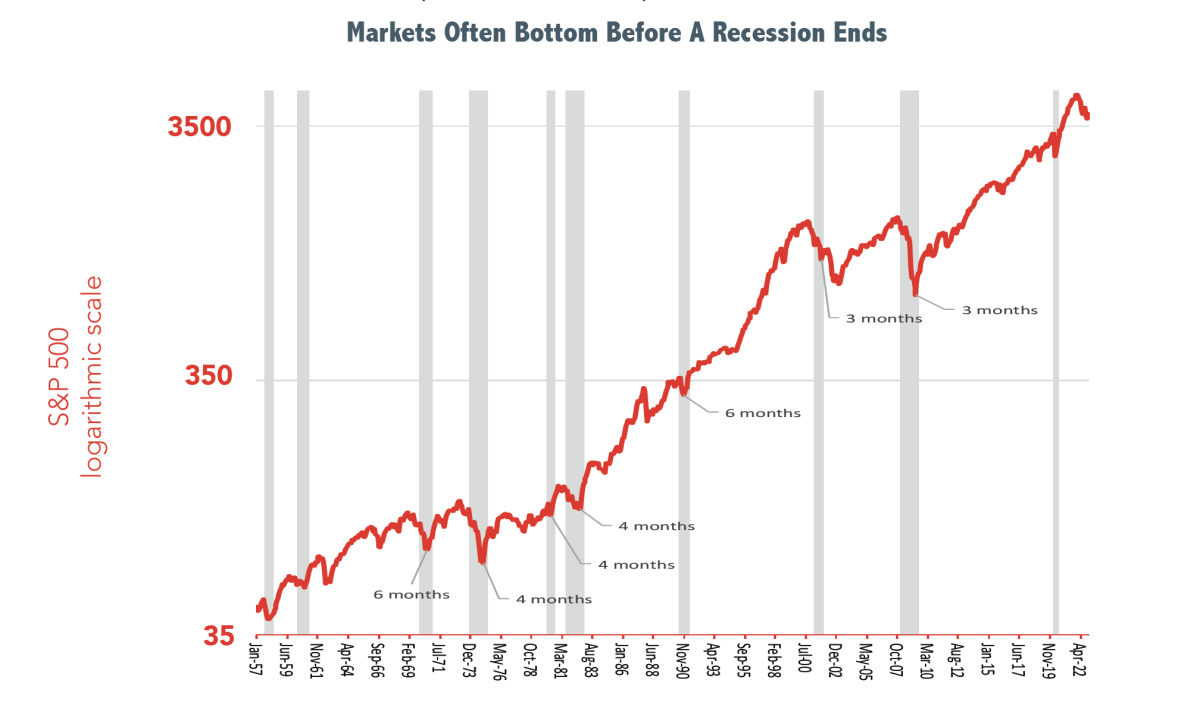

The answers to the above questions will be revealed in due time, but investors with an understanding of economics and financial markets needn’t exhaust too much energy debating them. There have been 10 recessions in the past 65 years with an average duration of 10 months and yet, the equity markets continued their ever-upward trajectory. That is because the values of the greatest companies grow along with the growth in our domestic and global economies. Also, since markets are anticipatory, by the time the economy recovers from a recession, equities will likely have bottomed several months previously. Experienced investors know this, as do their experienced financial advisors. Unfortunately, knowing and doing are not the same. Successful investors do not rely on intuition, flashing signals or financial journalists to direct their investment decisions and strategies. They more often rely on intelligent financial plans with goals funded by broadly diversified, low-cost, tax-efficient, risk-appropriate investment strategies, guided by the advice of experienced, dedicated professionals. Least of all, they will not rely on gut instinct or CNBC to gauge which direction the Federal Reserve will go next in its monetary policy decisions.

The answers to the above questions will be revealed in due time, but investors with an understanding of economics and financial markets needn’t exhaust too much energy debating them. There have been 10 recessions in the past 65 years with an average duration of 10 months and yet, the equity markets continued their ever-upward trajectory. That is because the values of the greatest companies grow along with the growth in our domestic and global economies. Also, since markets are anticipatory, by the time the economy recovers from a recession, equities will likely have bottomed several months previously. Experienced investors know this, as do their experienced financial advisors. Unfortunately, knowing and doing are not the same. Successful investors do not rely on intuition, flashing signals or financial journalists to direct their investment decisions and strategies. They more often rely on intelligent financial plans with goals funded by broadly diversified, low-cost, tax-efficient, risk-appropriate investment strategies, guided by the advice of experienced, dedicated professionals. Least of all, they will not rely on gut instinct or CNBC to gauge which direction the Federal Reserve will go next in its monetary policy decisions.

Best wishes for a safe, healthy, and prosperous New Year.